I’M GOING TO SHOW YOU HOW TO REPAIR YOUR CREDIT IN 30 DAYS

THE PROCESS ONLY TAKES AN HOUR.

It’s not as hard as everyone thinks. Send the letters and then wait for 30-

days for your results.

Here’s what you need to know: Credit bureaus and creditors do not have free rein to insert anything they want into your credit report, although it can happen. Credit bureaus must remove unverifiable items within 30 to 45 days, as required by the Fair Credit Reporting Act, Section 611, Part B, Subsection (iii). So, the law is on your side, and you have the right to dispute each item on your credit report. By law, the credit bureau must investigate, but it doesn’t always happen. In my experience, after multiple disputes, they sometimes send a letter apologizing for the item already being investigated.

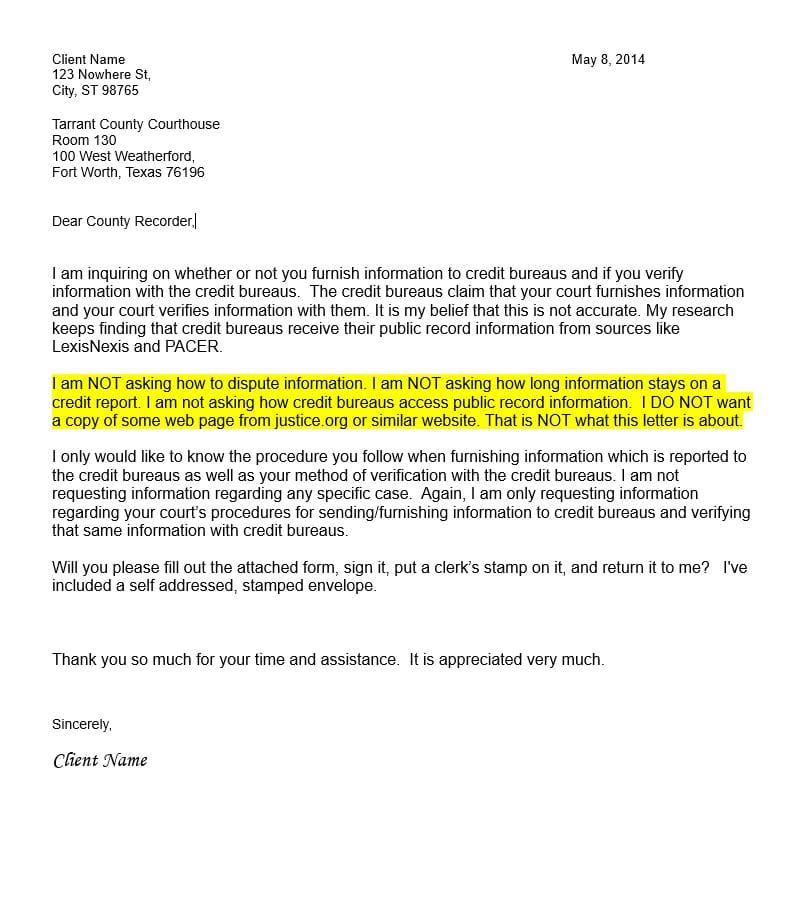

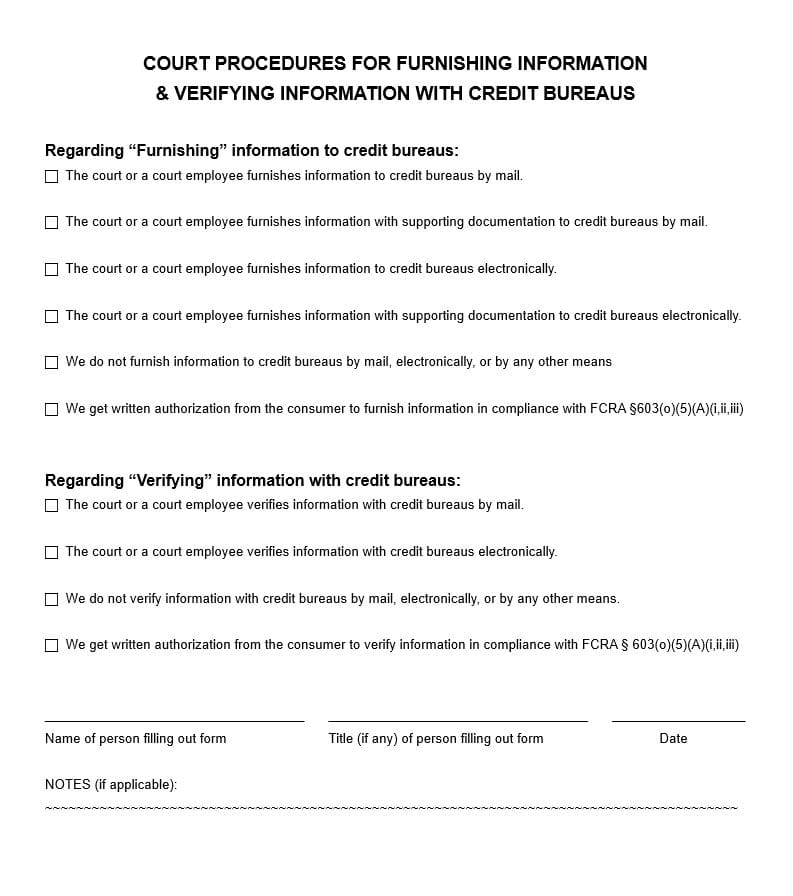

I keep disputing, and eventually, they delete it. If they don’t, I will contact the courthouse or the collection agency. For example, in 2015, I wrote a letter to the courthouse for my girlfriend, and after they filled out the paperwork, I sent it to the credit bureau. The item was deleted 7 days later.

Fun tip: The best time to dispute is around Christmas because they have limited staff.

Note: 64% of bureau complaints come from people who found inaccurate items on their report from total strangers.

Duration of items and what to look for:

– Personal credit history: 10+ years

– Closed inactive accounts: 10 years from the last payment date

– Derogatory items: 7 years; public records seven years from the payment date

– Chapter 7 & 13: 10 years from the filing date

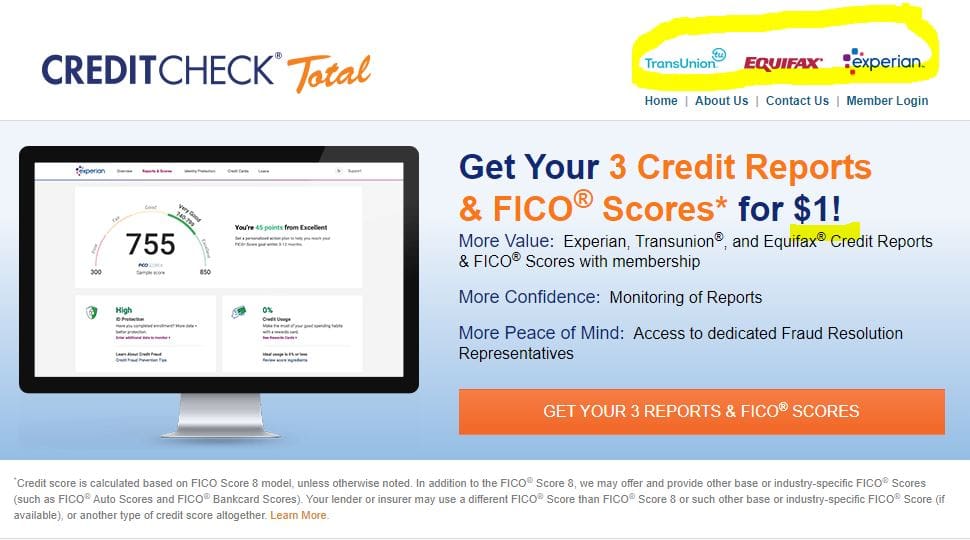

Now, let’s get started. Pull your 3-1 credit report and highlight negative items. Visit www.creditchecktotal.com (ensure it’s still $1), and remember to cancel within 20 or 30 days to avoid additional charges.

Check for the following items:

– Credit inquiries

– Late payments, past due, and unpaid payments

– Court judgments

– Collections

– Loan defaults

– Repossession

– Foreclosure

– Bankruptcy

They wrote her back and they filled out the paper and I sent it to the credit bureau. The item was deleted 7 days later.

Fun tip: The best time to dispute is around Christmas because they’re short of staff.

Note: 64% of the bureau’s complaints were from total strangers finding inaccurate items on their report

HOW LONG DO THE ITEMS STAY and what to look for

-

Your personal credit history – 10+ years.

-

Closed inactive accounts – 10 years from the date of last payment.

-

Derogatory items – 7 years public records seven years from the date of payment.

-

Chapter 7 & 13 – 10 years from the date filed.

Now we’re ready to begin

Pull your 3-1 credit report and circle all the negative items. www.creditchecktotal.com

( Make sure it’s still $1) you have to cancel in 20 or 30 days or they will charge you. So look that up to verify.

Items to look for

- Credit Inquiries

- Late payments, past due, and unpaid payments

- Court Judgements

- Collections

- Loan Defaults

- Repossession

- Forclosure

- Bankruptcy

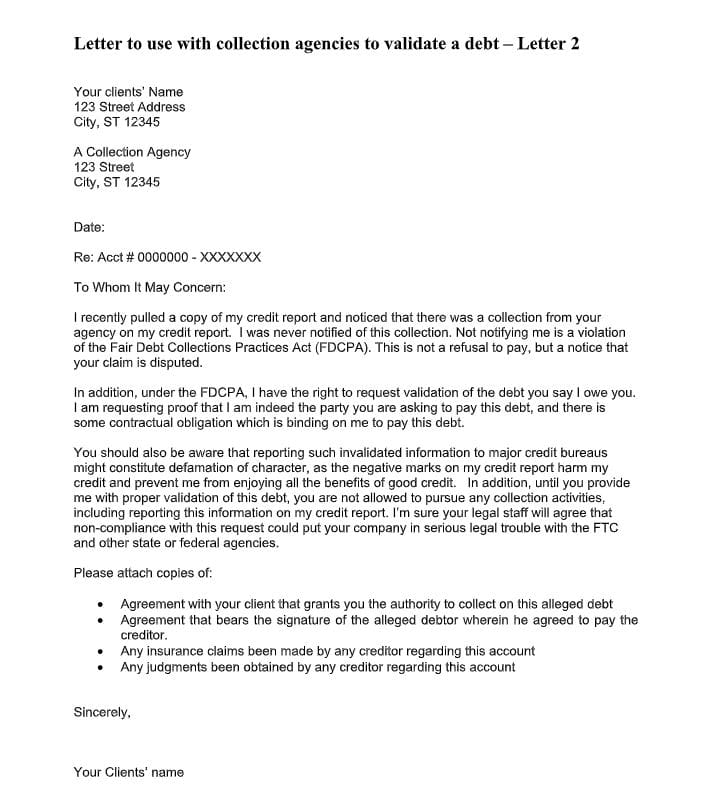

Before we draft the letter, we will be handwriting or using an italic font from our computers with a color ink or a colored pen. We are doing this because Experian, Equifax, and Transunion use a machine called E-OSCAR to read each letter. Since we are handwriting, using color and italic, the machine cannot read our letters and a real person will have to.

Note: The envelope must be handwritten. We don’t want to look like we are a credit repair company.

NCLUDE TWO BILLS IN YOUR NAME AND COPY OF YOUR DRIVERSLICENCE

Here is a sample first credit repair letter:

To begin, here’s a sample first credit repair letter:

Full Name

Address

City, State Zip Code

Social Security Number

Date

Credit Bureau Name: Transunion

Street Address

City, State Zipcode

To Whom It May Concern,

I have reviewed my credit report and discovered numerous errors. I kindly request your immediate investigation of the following discrepancies:

1. The bankruptcy listed as discharged on 10/20/10 is not mine and should be promptly removed.

2. The BBBC credit card with the account number XXXXXX45678 does not belong to me and should be deleted.

3. The Anders Hospital account for $296 with the account number xxxx67896 is not mine and should be removed.

4. My Macy’s credit card account, which I requested closed, has the number #36789. Please delete it.

I would like you to correct these inaccuracies by removing these items from my credit report without delay. Additionally, I kindly request an updated copy of my credit report to be sent to me.

Thank you for your attention to this matter.

Sincerely,

Jodi Uchuys

P.S. Please include two current bills in my name (with matching address) and a copy of my driver’s license in the envelope. I have also included my Social Security number and date of birth on this letter. I have sent this letter via certified mail and will track it to ensure a response within 30-45 days. Kindly send this letter to each credit bureau since they may report different items.

Credit Bureau Addresses:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374-0256

Experian

P.O. Box 4500

Allen, TX 75013

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

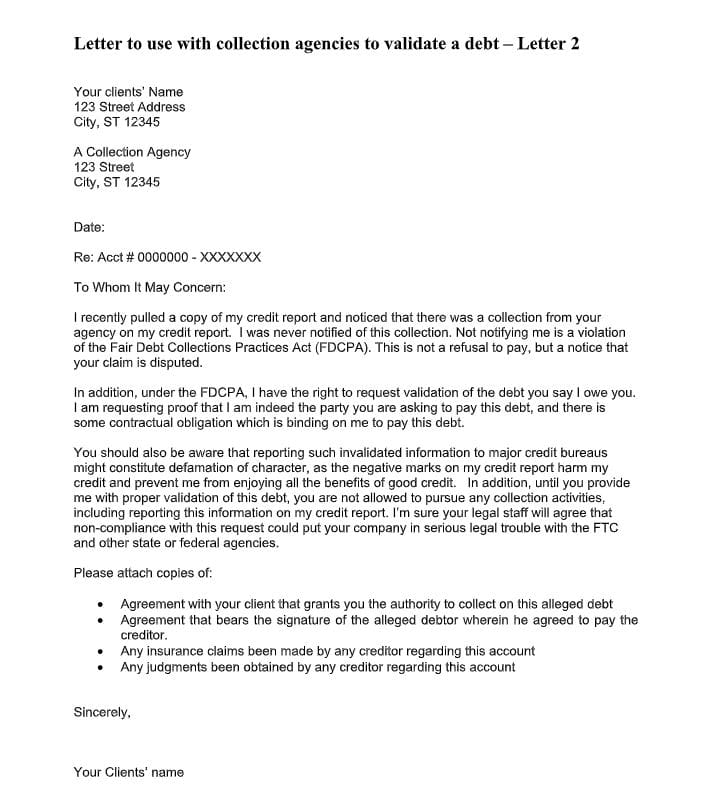

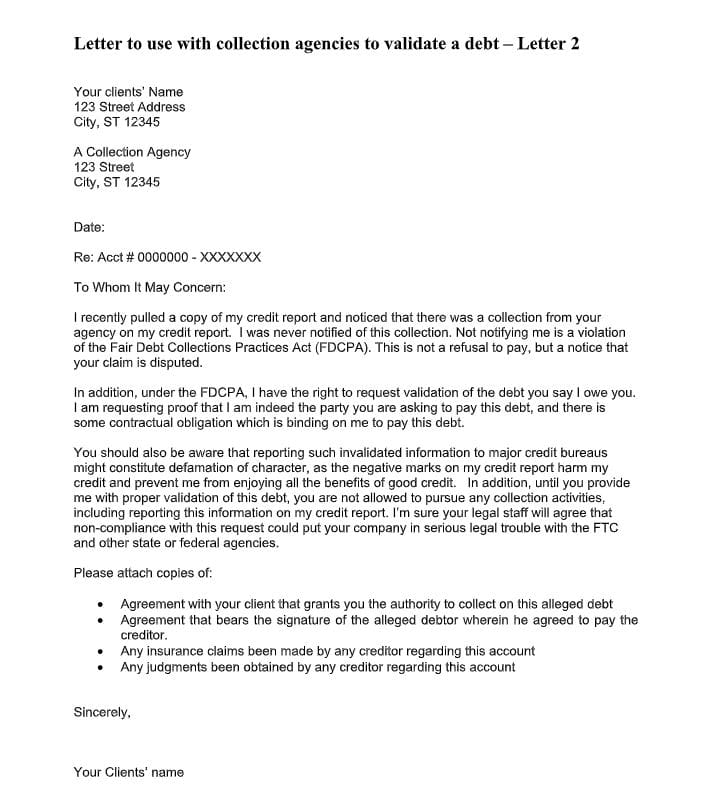

Collection agency letter example

Fun tip: Best time to dispute is around Christmas. Short of staff.

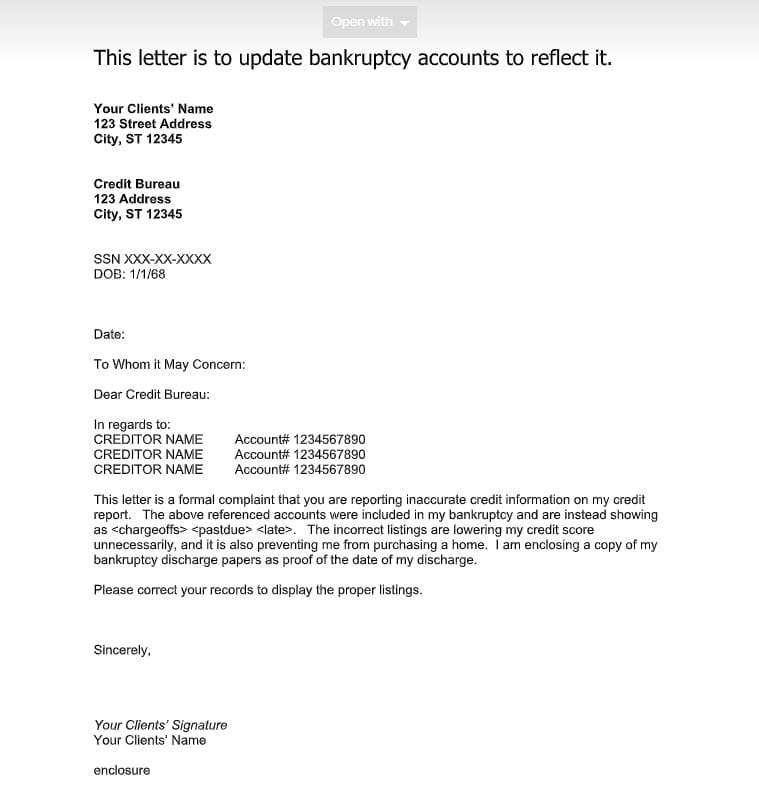

Bankruptcy Letter

Note: 64% of the bureau’s complaints were from strangers finding inaccurate items on their report. Here’s how long items typically stay and what to look for:

1. Personal credit history: 10+ years

2. Closed inactive accounts: 10 years from the date of last payment.

3. Derogatory items: 7 years

4. Public records: 7 years from the date of payment.

5. Chapter 7 & 13: 10 years from the filing date.

Let’s begin with step 1:

1. Pull your 3-1 credit report and circle all the negative items. Visit www.creditchecktotal.com (Make sure it’s still $1). Remember to cancel within 20 or 30 days to avoid charges.Items to look for:

– Credit inquiries

– Late payment – Past due and unpaid payments

– Court judgments

– Collections

– Loan defaults

– Repossession

– Foreclosure

– Bankruptcy

Now, a little bit about me and how I know so much about credit. When I was 26, my credit was so bad that even getting a gas card was denied. I couldn’t move into the apartments I wanted, and it was a disaster. During my 7-month bed rest while pregnant, I immersed myself in reading every single book and court case about credit repair. After giving birth, my credit score was around 760, and I started fixing everyone’s credit. Within a year, I was managing 4 credit repair offices in 4 different states. Funny how things happen!